Choose a language to download:

Who can apply?

You can apply if:

- You were in Australia on a temporary visa

- You have now left Australia or will be leaving soon

- Your visa has expired or been cancelled

- Your super account has not already been sent to the ATO as unclaimed money (if it has, contact the ATO directly as you must make your claim directly with them)

Check the full rules at the ATO DASP page.

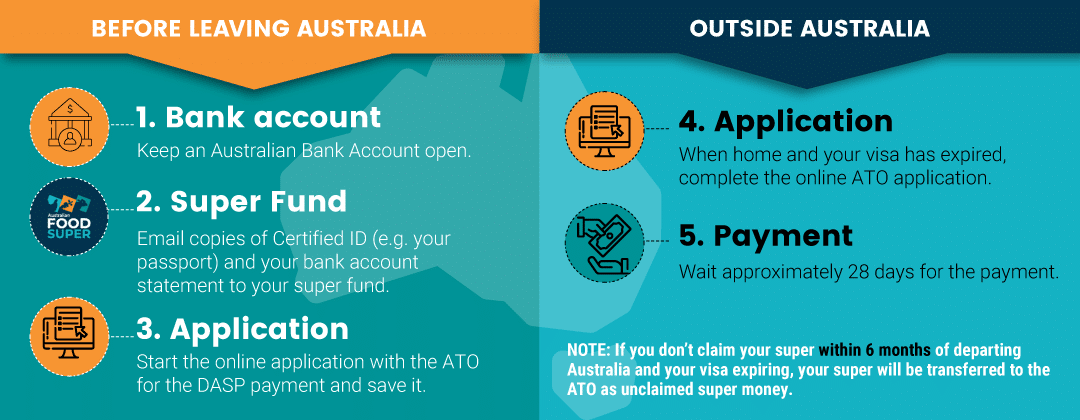

What to do before you leave Australia.

- Keep your Australian bank account open. We recommend that you receive your super into this account. It is faster and easier. If the account is closed, the payment will fail. It can also be paid by International Money Transfer (for fund applications only) however this will take significantly longer than if it is paid into an Australian Bank account.

- Take a photo of your Australian bank statement (the account that is to receive the funds). Make sure it is a recent statement and that the photo is clear and not edited.

Your Australian bank statement must show:- Bank letterhead

- Your name

- Your BSB and account number

- Get a copy of your passport certified (see next section about Certified Documents) and take a photo of it, making sure it is clear and not edited. Your name in your passport must match your name on your super account. If your name is different, please contact us to get a Change of Name form before you apply.

Email the photo of your recent bank statement and the certified copy of your passport to service@ausfoodsuper.com.au

What is a Certified Document?

A certified document is a copy of your passport that has been signed by an official person, such as:

- Police Officer (Australia)

- Justice of the Peace

- Notary Public

- Court official

- Australian Embassy or Consulate staff

- Doctor

They must:

- Write “certified true copy”

- Add their name, job title, signature and the date

You must then take a photo of this certified document, making sure all the information is clear and it is not edited in any way. Email the photo to service@ausfoodsuper.com.au

How to apply for your superannuation (DASP)

You must apply online through the Australian Tax Office (ATO) here. You need to start this process before leaving Australia but can only complete it when you have returned home and your visa has ended.

You can save your online application and return to it later if needed.

Do not complete and submit this until you have returned home.

What details you need for the Form

When filling in your DASP application, you may need the following information:

- Fund name: Australian Meat Industry Superannuation Trust (trading as Australian Food Super)

- ABN: 28 342 064 803

- USI: 28342064803589

- SPIN: AMI0100AU

- SFN: 268997940

- Phone: 1800 808 614 (in Australia) or +61 2 8571 5453 (overseas)

What to send us after your application is approved

Once the ATO approves your application, they will send a copy to you and to us. We will then contact you to complete the payment process.

Important notes

A higher tax will be taken from your payment because you are a non-resident. Your online super account will be closed once your payment is made. The DASP process may take several weeks. Please be patient.

Need help?

Contact Australian Food Super from anywhere

Within Australia: 1800 808 614

Overseas: +61 2 8571 5453

Email: service@ausfoodsuper.com.au

Or visit the ATO DASP website for more information in English and other languages.

ATO help

- In Australia— on 13 10 20 between 8:00am and 6:00pm Monday to Friday.

- Outside Australia—on +61 2 6216 1111 between 8:00am and 5:00pm Monday to Friday (AEST) and ask to be transferred to 13 10 20.

- If you would like to speak in a language other than English, phone the Translating and Interpreting Service (TIS National) on +61 3 9268 8332 and request to be connected to the ATO in the language you wish to speak.

The PALM (Pacific Australia Labour Mobility) Scheme website also provides superannuation guides in different languages.