Choose another language:

What happens to super when a member leaves the country permanently?

Understanding the Departing Australia Superannuation Payment (DASP) process can be essential if you are planning to leave Australia permanently. DASP allows eligible people, such as temporary residents, to access their superannuation savings upon departure from Australia. Here’s how the DASP process works:

1. Eligibility Criteria

DASP is available to you if you are not an Australian or New Zealand citizen or Australian permanent resident, and you are departing Australia permanently. This often includes people on temporary visas, such as work visas or student visas, whose visas have expired or been cancelled. It’s important to check eligibility criteria carefully to ensure the requirements are met before proceeding.

2. Application Process:

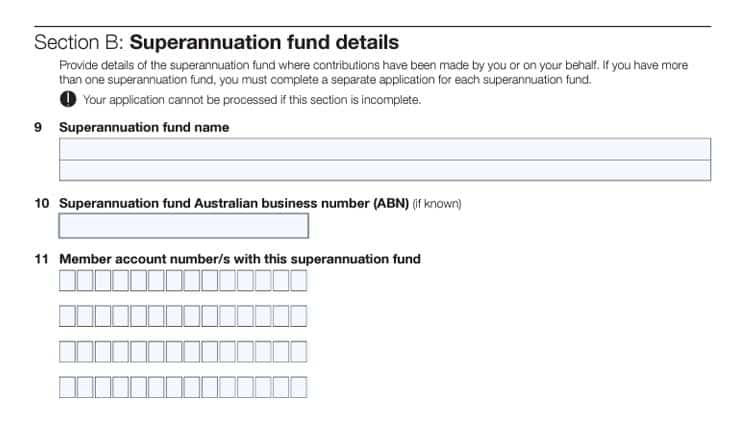

The first step in accessing your superannuation funds through DASP is to apply to the Australian Taxation Office (ATO), which oversees the DASP scheme. The application can be completed online through the ATO website or by filling out a paper form. Accurate and complete information should be provided to avoid delays in processing the application. The ATO website provides instructions on how to complete the form. In particular, note that you need to provide your superannuation fund details on the form (see below). For Australian Food Super the ABN is 28 342 064 803 and you will find your member number on your superannuation statement.

3. Supporting Documentation:

Along with the application, supporting documentation is required, such as proof of identity, visa details, and evidence of your departure from Australia. This could include a copy of your passport, visa documents, and flight tickets or other proof of departure. Gathering these documents beforehand can help streamline the application process.

4. Tax Considerations:

It’s important to understand the tax implications of DASP. Superannuation payments made to temporary residents are subject to withholding tax, which is deducted by the superannuation fund before the payment is released. The withholding tax rates vary depending on the amount of the superannuation benefit and your residency status.

5. Processing Time:

Once the application and supporting documents are submitted, the ATO will review and process the DASP payment. Processing times can vary depending on various factors, including the completeness of the application and the ATO’s workload. It’s essential to be patient and allow sufficient time for the application to be processed.

6. Receipt of Payment:

Once the DASP application is approved and processed, the superannuation funds will be provided as a lump sum payment. The payment will be made directly, usually via electronic transfer to a nominated bank account. Always double-check the bank account details to ensure the payment is deposited correctly.

7. Additional Support:

If difficulties are encountered or there are questions about the DASP process, resources are available to help. Contact the ATO for assistance or seek guidance from immigration advisors or financial professionals who specialise in superannuation matters. In addition, the Australian Food Super client services team is also available to answer questions and guide you through the process.

In summary, the Departing Australia Superannuation Payment is a valuable resource if you are leaving Australia permanently. By understanding the eligibility criteria, completing the application accurately, and considering tax implications, you can access superannuation savings smoothly and efficiently before departing Australia for good.

For further information on DASP, contact your Client Services Manager or you can also visit the ATO website by clicking the video image below.

Choose another language: